“Order a fortune with the Kraken command book and limit orders”

In the world of trading of cryptocurrencies, there are different tools at your disposal to effectively execute transactions and with precision. Two crucial concepts that can help you achieve this goal are limit orders and command books. In this article, we will immerse ourselves in these two concepts and explore how they work together to give you an advantage in the cryptocurrency market.

** What is a limit order?

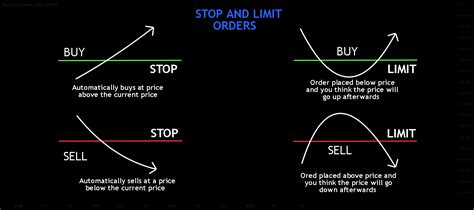

A limit order is a type of purchase or sale order which specifies a specific price to which you wish to enter or leave the market. Unlike Stop-Loss orders, which automatically sell at a certain price when the action reaches a predetermined level, limit commands allow you to specify your own target price for each profession.

When you place a limit order on an cryptocurrency exchange like Kraken, you will be asked to enter the following details:

- Buy or sell

- Quantity (the number of tokens or units)

- Price (the specific amount you are ready to pay)

- Type (Limit) – Specify whether it is an “AT Market” command (AMM) or a “Market” command

For example, if you want to buy 10 bitcoin at $ 50,000, your limit order would be: “Buy 10 Bitcoin at $ 50,000.”

** What is a command book?

A order book is a digital recording of all market players for a particular asset. It shows the quantity and price of each type of order subjected by merchants or individual scholarships. The order book provides valuable information on market conditions and helps you assess the probability of filling your businesses.

The Kraken order book, in particular, offers 25 million pairs of cryptocurrencies against exchanges. You can display the current prices of various assets and even access the real -time quotes of market players. This allows you to identify potential trading possibilities and adjust your strategy accordingly.

How do the limits of operation with control books?

When you use the Kraken command book, you will notice that there are serious limit orders:

* Orders of the market

: These allow you to enter or leave the market at all costs, that it does not correspond to the current market.

* Orders Stop-Loss : These automatically sell at a certain price when the action reaches a predetermined level (for example, 10% below your entry price).

* Orders properly : these target specific prices for your long positions and will be automatically sold.

By combining these tools with the Kraken command book, you will access more precise market information and better decision -making. For example:

- If the current market is $ 10,000, but you want to buy 100 bitcoin at this price (a limit order), you can enter an exchange at this price from your Kraken account.

- When you use stop-loss commands or for profit on the same asset, the Kraken command book allows you to monitor and adjust these strategies in real time.

Conclusion

Order books provide essential information on market conditions and allow traders like you to make an informed decision in their cryptocurrency trades. By combining the limits of orders with access to a robust command book like Kraken, you can run transactions more efficiently, minimize risks and potentially increase your yields on investment.

Thus, the next time you plan a job or are looking for ways to optimize your cryptocurrency strategy, be sure to explore the world of books and command limitations-you could simply discover new opportunities to take advantage of this volatile market.