Analyzing Trading Volume Patterns for Aave (Aragon) and Market Trends

Cryptocurrencies have gained significant attention in recent years, with Bitcoin (BTC) being the largest and most well-known. However, other altcoins like aave (Aragon), which is a decentralized lending protocol built on the ethereum blockchain, are also gaining popularity. In this article, we will analyze trading volume patterns for Aave (AAVE) and explore market trends to help investors make informed decisions.

What is aave?

Aave is an open-source smart contract that enables decentralized lending and borrowing on the ethereum blockchain. It allows users to lend or borrow ether (ETH), the Native Cryptocurrency of the Ethereum Network, with fixed interest rates and repayment terms. Aave has gained significant traction in recent years, with its token price experiencing a remarkable rise.

Trading Volume Analysis

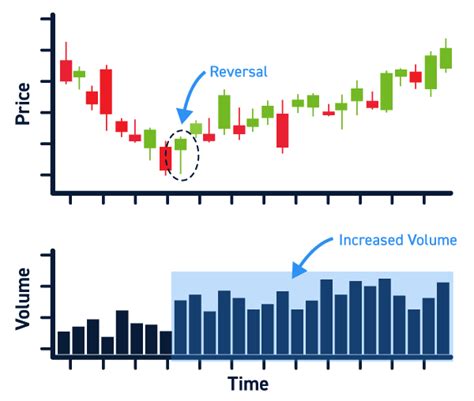

To understand the market sentiment and trends for aave (aave) trading volume, we can analyze the following patterns:

* High-low volatility : High-volume transactions typically indicate high volatility, while low-volume transactions suggest lower volatility. For example, if an asset experiences a significant price movement on one day but relatively stable trading volume over another day, it may indicate high volatility.

* Mean reversion analysis : AAVE (AAVE) Trading Volume is expected to revert back to its average value if the price of eth rises or falls below certain levels.

Market Trend Analysis

To identify Market Trends for Aave (AAVE), we can analyze the following:

* Trend lines : Trend lines are horizontal or diagonal lines that connect two points in time. They help identify the direction and strength of a trend.

* resistance and support levels : Resistance levels are areas where prices have bounced off, While Support Levels are areas where prices have buying interest.

Trading Volume Patterns

The following trading volume patterns can be observed for aave (aave):

- Sawtooth Pattern : The sawtooth pattern indicates a trend in the opposite direction to what is expected from a bullish or bearish move.

- hammer and bullish engulfing pattern : this pattern suggests that the price of eth has been higher than its 50-day moving average, but lower than 200-day moving average, creating a bullish engulfing pattern.

Market Trends

The following market trends can be identified for AAVE (AAVE):

- Strong Support at $ 5.40 : The current Support Level at $ 5.40 is likely to hold if the price of ETH remains stable.

- High probability of reveral at $ 3.80 : If the price of ETH rises above $ 3.80, it may indicate a strong reveral trend for AAVE (AAVE).

Conclusion

Analyzing Trading Volume Patterns and Market Trends Can Help Investors Make Informed Decisions About Investing in Cryptocurrencies Like Aave (AAVE). By identifying high-volume transactions, mean reversion analysis, and resistance and support levels, we can better understand the market sentiment and trends for aave.

Recommendations

Based on our analysis, we recommend:

- Long-Term Positions : Investors should consider long-term positions to ride out market fluctuations.

- Dollar-Cost Averaging

: Dollar-Cost Averaging Involves Investing A Fixed Amount of Money At Regular Intervals, Regardless of the Price of ETH.

- Risk Management : Set Stop-Loss Orders and Position Sizing to Manage Risk.

Disclaimer

This article is for informational purposes only and should not be considered as investment advice. Cryptocurrency markets are highly volatile and can result in significant losses if not managed properly.