Decentralized Stablecoins: A New Approach to Financial Systems

The world of finance is undergoing a major transformation with the rise of decentralized stablecoins. These digital currencies are built on blockchain technology and use advanced algorithms to preserve their value relative to traditional fiat currencies, making them an attractive alternative to traditional monetary systems.

What are Stablecoins?

A stablecoin is a type of cryptocurrency that is pegged to a traditional currency or asset, such as the US dollar. This means that the value of the stablecoin remains relatively stable relative to the value of the underlying asset, ensuring that investors can trust its purchasing power.

Stablecoins were first introduced in 2014 by David Sutcliffe, an Australian entrepreneur who wanted to create a cryptocurrency that would allow people to buy and sell goods and services without relying on traditional payment systems. The first stablecoin, Tether (USDT), was launched in August of that year and quickly became popular due to its low transaction fees and ease of use.

How Decentralized Stablecoins Work

Decentralized stablecoins are built on blockchain technology, which allows them to be transparent, secure, and decentralized. This means that there is no single entity that controls or manipulates the supply of stablecoins, making them more resistant to manipulation and censorship.

Stablecoins are typically issued through an initial coin offering (ICO) process, where investors can buy shares in the project and receive a share of the profits from the sale. The remaining assets are then used to mint new coins, which are distributed among validators on the blockchain network.

Advantages of Decentralized Stablecoins

Decentralized stablecoins have several advantages over traditional monetary systems:

- Security: Since there is no central authority controlling the delivery of stablecoins, it is more difficult for hackers or malicious actors to manipulate their value.

- Transparency: The decentralized nature of stablecoin networks means that all transactions are visible and transparent, making it easier to track the movement of funds.

- Accessibility: Decentralized stablecoins can be used by anyone with an internet connection, regardless of their geographic location or financial situation.

- Low transaction fees

: The low transaction fees associated with decentralized stablecoin networks make them more attractive to users who want to send and receive cryptocurrencies without high costs.

Challenges and Limitations

While decentralized stablecoins have many advantages, they also face a number of challenges and limitations:

- Regulatory Uncertainty: Decentralized stablecoins operate in a gray area when it comes to regulatory requirements, making it difficult for governments to determine what is acceptable.

- Scalability: Currently, many decentralized stablecoin networks are not scalable enough to support widespread adoption, limiting their growth potential.

- Security Risks: As with all digital currencies, decentralized stablecoins are at risk of security vulnerabilities or hacking attacks.

Real-World Examples

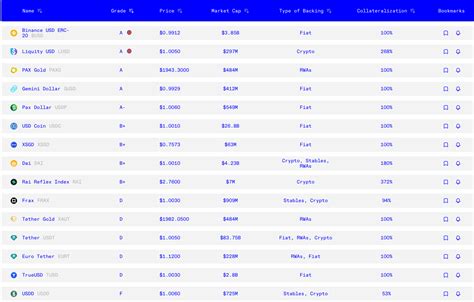

There are a number of companies and projects working on developing decentralized stablecoins, including:

- Tether (USDT): Tether is one of the most widely used decentralized stablecoins, with over $300 billion in total value in its reserves.

- MakerDAO (DAI): MakerDAO is a decentralized stablecoin that uses a unique algorithm to maintain its fixed value against the US dollar.

- Compound (COMP): Compound is another popular decentralized stablecoin that allows users to store and manage their cryptocurrencies in a decentralized manner.