“Invisible Danger Fintech: Understanding the Dynamics of the Cryptocurrency Market”

Because the world is becoming more and more digital, the world of cryptocurrency is developing at a growth rate that is difficult to ignore. However, under the surface of this quick extension lies a complex network of risk and challenges that may have a far -reaching implications for investors and users.

One of the key metrics, which paints the image of the Dynamics of the Cryptocurrency Market, is open interest. Open interest measures the number of overdue current contracts in specific assets over time, which gives insight into its general demand and supply. In cryptocurrencies, such as Bitcoin and Ethereum, High Levels of Open Percentage Indicate Strong Purchasing Pressure and Can Signal An Upcoming Price Increase. And vice versa, the low open interest may suggest bears.

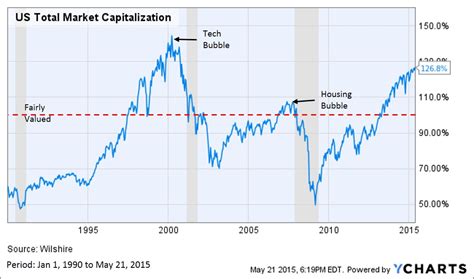

Market Capitalization (Market Capitalization) is Another Critical Indicator. As the total value of all overdue tokens on the cryptocurrency exchange increases, its market capitalization exponentially. This record serves as a measure of the general size and impact of the cryptocurrency ecosystem. Fast -Growing Market Capitalization may indicate increased adoption and id in a wider financial system.

However, even with these indicators, there is still one key factor to consider: the risk of settlement. The process of buying, selling and settling cryptocurrency transactions is based on reliable services of other companies, such as Stock Exchanges, Banks and Payment Processors. If the service fails or experiences technical difficulties during the settlement process, it can lead to significant losses for users and potentially destabilize the entire ecosystem.

The billing risk is particularly disturbing, because it is associated with the potential loss of assets and cash flows for investors who deposited their coins into Third -Party Services. For example, if the exchange or payment processor results from its obligations, investors may lose access to their funds, which causes significant financial losses.

To reduce this risk, exchange and other service providers must implement solid emergency plans and implement examples to prevent such scenarios. In addition, the increase in decentralized exchange (DEX), which operate regardless of traditional exchanges, helps increase the security and reliability of cryptocurrency transactions.

While cryptocurrencies still exceeded the boundaries in terms of growth rates and adoption, both investors and users are aware of these invisible threats that can affect their financial interests. Understanding open interest, market capitalization and the risk of resolution, people can make more conscious decisions when investing in the world of cryptocurrency.

Sources:

- Open Interest Rates Come From CoinMarketCap and Cryptoslation.

- Market capitalization is based on data from Coingcko and CoinMarketcap.

- Settlement risk analysis is based on Industry Reports and Press Articles.