The emergence of cryptography trade competitions: how the winners are crowned

The world of cryptocurrency has exploded in popularity during the last decade, with the prices that are fired and new coins are thrown daily. However, for those who have been around the block (or should we say, the block chain?), The real question is: how do merchants remain in front of the game? ENTER: Cryptographic trade contests.

In this article, we will deepen the world of cryptocurrency trade competitions, exploring what they are, how they work and which offer a public sale for participants to compete. We will also examine the consensus mechanism that underlies these events, highlighting its importance in obtaining the integrity of Blockchain networks.

What are cryptography trade competitions?

Cryptography trade competitions are online competitions where merchants can compete with each other to achieve the best results in cryptocurrency markets. These competitions are generally held by well -established exchanges and platforms, with the aim of crowning the main merchants that demonstrate exceptional skills and strategies for success.

Competition formats may vary, but common issues include:

- Make the market : Participants buy and sell large amounts of cryptocurrencies at prevailing prices in the market to maximize their profits.

- Position trade : Merchants enter and leave positions based on short -term market movements, with the aim of benefiting from price changes.

- Strat funds : Investors create personalized investment strategies using algorithms or statistical models to achieve yields.

How do cryptography trade competitions work?

To participate in a competition, merchants must follow these steps:

- Register : Register with the participating exchange and platform.

- Create an account : Configure a negotiation plan and receive access to competition tools.

- Choose your strategy : Select pre -constructed models or create your own customs using several tools and libraries (for example, tradingView, quantopian).

- Start operating : Enter the positions according to the chosen strategy.

- Tracking performance : Monitor its results, including profits, losses and return on investment.

Consensus mechanism: ensure the integrity of blockchain networks

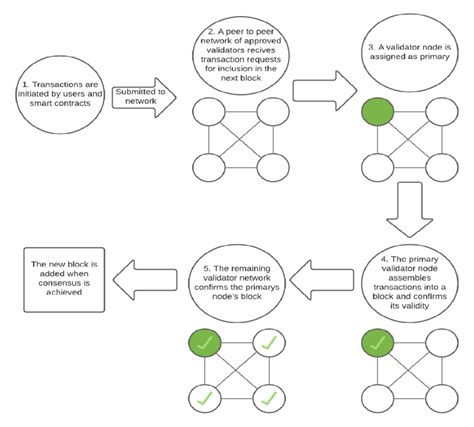

The consensus mechanism is a critical component of the Blockchain networks, ensuring that the transactions are verified and validated by multiple nodes (computers) before being accepted as legitimate. In cryptocurrency, this process implies:

- MINING : Miners compete to solve complex mathematical puzzles in exchange for freshly minted currencies.

- Validation : The nodes verify the puzzle solutions, and their votes determine the content of the next block.

The consensus mechanism ensures that all transactions are:

* Decentralized : No unique entity controls the network; The nodes validate transactions independently.

* IMMUTABLE

: Transactions are recorded in a major book (Blockchain), which makes them manipulations.

* Directed by consensus : The nodes agree on the validity of transactions through a collective decision -making process.

Public sale: a crucial step for competition participants

A public sale, also known as an initial currency offer (ICO) or a tokens sale, allows participants to buy and sell cryptocurrency tokens directly from the creators. This provides several benefits:

- Lower entry barriers : Less regulatory obstacles; It is not necessary to obtain licenses or follow strict guidelines.

- Increase in liquidity : More buyers and vendors participating in the market can increase prices.

- Reduced volatility : Mercades established for specific tokens, reducing price fluctuations.

Public sales offer an exciting opportunity for merchants to participate in competitions while providing a way for creators to raise funds for their projects.